Changes to Casual Employment in August 2024

Casual employment is set to change again after Amendments to the Amendments to the Fair Work Act 2009 (Cth).

.

On the 26th August the following changes will come into effect:

· There is a new definition of casual employment

· The pathway for casuals to move to permanent employment has changed

· Issuing the casual employment information statement has a new arrangement

This information is applicable to national employers only and does not apply to employers in the state system.

New definition of casual employment

A new definition of ‘casual employee’ will be introduced. Under this definition, an employee is only casual if:

· There is no firm advance commitment to continuing and indefinite work; and

· They are entitled to receive a casual loading or specific casual pay rate

It is important to note that this definition will focus on the true nature of the employment rather than just the written terms of the employment contract. It’s important to be aware that even if there is an absence of a firm advance commitment to continuing and indefinite work the employment will be assessed on the basis of the ‘true nature’ of the employment relationship.

New pathway for converting from casual to permanent

The current rules for casual conversion are being abolished. An offer of permanent employment is no longer required for employers to offer casual employees.

Instead, it will be up to the employee to notify you of their intention to change to permanent employment if:

· They’ve been employed for at least 6 months (for employers with 15 or more employees) or 12 months (for employers with less than 15 employees); and

· They believe they no longer fit the definition of a casual employee.

Casual employment information statement (CEIS)

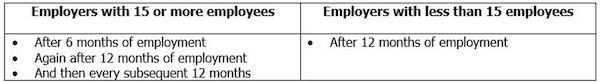

A new obligation will exist for providing the Casual Employment Information Statement (CEIS) to casual employees. In addition to providing the CEIS to casual employees on commencement, employers will now be required to provide the CEIS:

What you need to do?

· Review your casual workforce and assess these employees against the new definition

It is very important that employers ensure they meet their ongoing obligations under these new arrangements. Employers need to put a mechanism in place to remind them to meet the new obligation, see Table ablve, for issuing the Casual Employment Information Statement at the required times.